The annual contribution limits for flexible spending accounts (FSA) and health savings accounts (HSA) are changing in 2022. Learn about the biggest adjustments into the new year, which include the newest COVID-19 relief measures and how you can plan for the new limits. For a rundown of the differences between FSAs and HSAs, check out our blog on how these accounts work.

Table of Contents

A. Changes to FSA and HSA Contribution Limits

1. Why Do Contribution Limits Change?

2. COVID-19 Relief for FSA Rollover Limits

3. Changes to High-Deductible Health Plans (HDHP) Out-of-Pocket Limits

B. What Can You Buy with Leftover FSA Funds?

C. FSA/HSA Eligible Prescription Eyewear at SportRx

Changes to FSA and HSA Contribution Limits

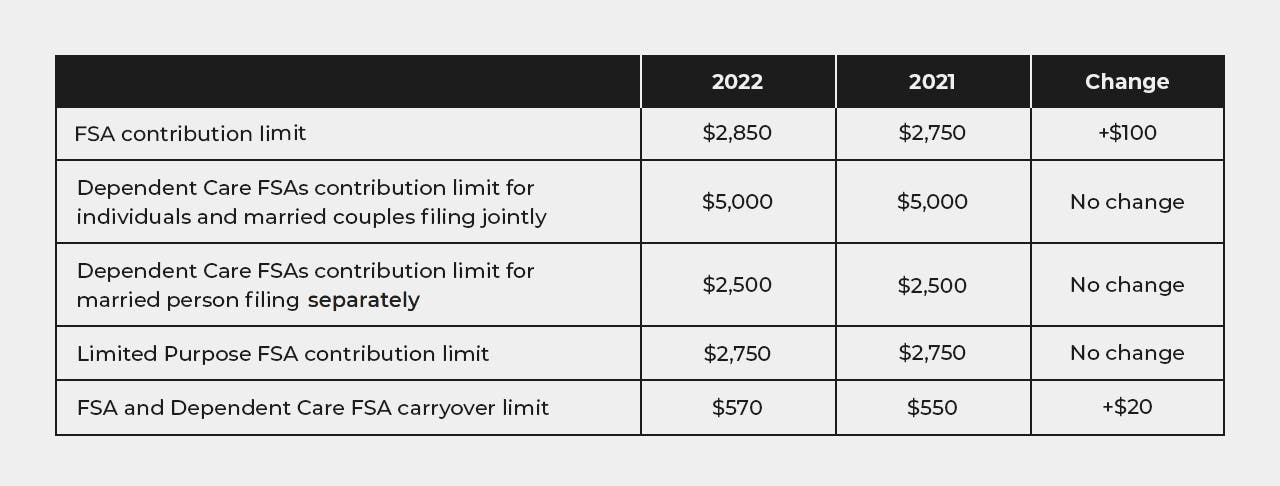

In November, the Internal Revenue Service (IRS) announced that the employee contribution limit for health care FSAs is increasing to $2,850 for 2022. For dependent-care FSAs, the contribution limit remains at $5,000 for individuals, or married couples filing jointly, and $2,500 for a married person filing separately. Although uncommon, it’s possible to have an FSA and an HSA at the same time. For HSA-compatible FSAs, the limit remains at $2,750.

Meanwhile, contribution limits for HSAs have increased to $3,650 for individual coverage and $7,300 for family coverage. This is up $50 and $100, respectively, from 2021.

While the IRS announced HSA changes in May 2021, the new FSA limits weren’t announced until November 2021 — which was during or after open enrollment for most employers. This means that employers might not change their FSA contribution limits until 2022. Check with your benefits provider to clarify the new change in the FSA limit.

Why Do Contribution Limits Change?

HSA and health care FSA providers generally adjust annual contribution limits for inflation and round them to the nearest $50. Decide which plan is best for you and your lifestyle by determining the medical expenses you expect to incur in the new year, and if the new limits provide the coverage you need.

COVID-19 Relief for FSA Rollover Limits

While HSA funds roll over every year, FSA funds expire at the end of the year. If your employer's plan allows it, you may carry over up to $570 of your unused health care FSA funds from 2022 into 2023 — up $20 from the $550 limit allowed from 2021 into 2022.

However, the Consolidated Appropriations Act, 2021 extended COVID-19 relief efforts by allowing FSA holders to carry over their full amount of unspent FSA balance into 2022. This effort extends the spending grace period (which is typically two and a half months into the new year) to 12 months after the end of 2021.

Businesses may not necessarily provide this extra relief, so check with your employer on your eligibility for these extended benefits.

Changes to High-Deductible Health Plan (HDHP) Out-of-Pocket Limits

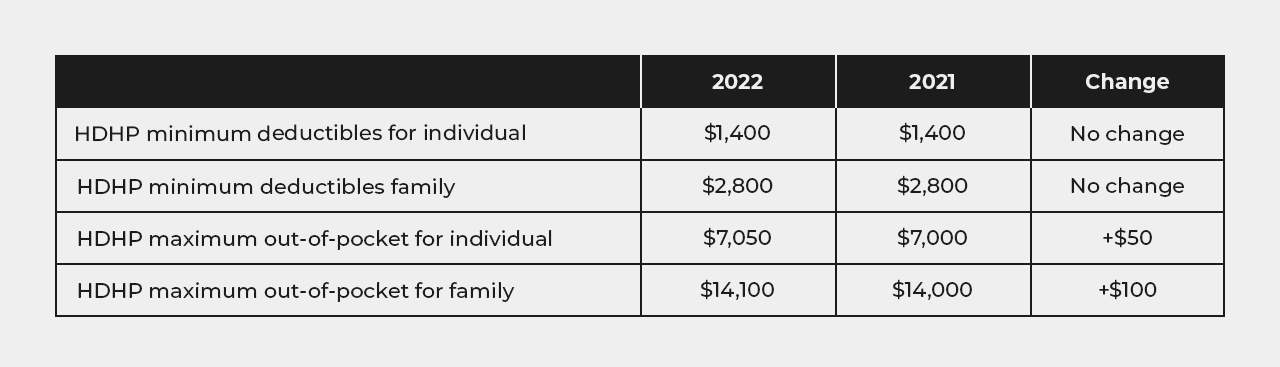

The minimum deductibles for HSA-qualified high-deductible health plans will remain at the amounts set for 2021: $1,400 for individual coverage and $2,800 for family coverage. The maximum out-of-pocket amounts (for example, money spent on deductibles and copayments) increased by $50 for a $7,050 limit for individual coverage and $100 for a $14,100 limit for family coverage.

What Can You Buy with Leftover FSA Funds?

There are many medical products that qualify for flex or HSA spending — including prescription eyewear! If you choose to buy a pair of prescription eyeglasses or sunglasses from SportRx, we accept FSA and HSA cards at checkout — and can even split the total cost between different cards. If you have a spouse or kids, you can also use your own FSA money for their prescription eyewear expenses. Prescription eyewear, however, is not qualified for reimbursement under dependent-care FSAs.

FSA/HSA Eligible Prescription Eyewear at SportRx

Ready to use your FSA or HSA funds on prescription eyewear? When you shop with us, you’ll find video guides and tool tips throughout the build process as you customize the perfect pair. An answer to all your questions is at your fingertips, and if you want to chat with an expert, contact us. We’ll put you in touch with one of our friendly in-house opticians who can help you build your prescription eyewear.

Ditch risky online shopping with our See Better Guarantee. Try your glasses or sunglasses for 45 days. If you’re not satisfied, send them back. Get a full refund, exchange, or credit towards a better pair. And return shipping? Covered. Get your pair of prescription glasses or sunglasses at SportRx today!

Shop All FSA/HSA Eligible Prescription Eyewear

Disclaimer: This content is provided solely for informational purposes. It is not intended as and does not constitute legal advice. The information contained herein should not be relied upon or used as a substitute for consultation with legal, accounting, tax and/or other professional advisers.